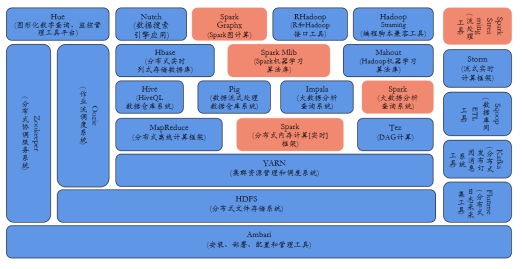

Faced with the competitive pressure of internet finance, financial enterprises urgently need to restructure their decision-making and service systems based on big data analysis and mining, to enhance their competitiveness and customer satisfaction. In the era of big data, banks will shift from a transaction centric approach to a data centric approach to address the challenges of more dimensional, massive, and real-time data and internet business.

At present, the concept that data is an important asset has become a consensus in the financial industry. As the carrier of financial business is increasingly integrated with social media and e-commerce, the analysis of the original structured data can no longer meet the needs of development. It is urgent to break the data boundary with the help of big data strategy, including more and stronger big data analysis, to build a more comprehensive panoramic view of enterprise operation. Big data can solve the storage of massive data in the financial field, query optimization and processing of unstructured data such as voice and image. The financial system can use big data analysis platforms to import data generated by customer social networks, e-commerce, and terminal media, thereby constructing customer views. Relying on big data platforms, customer behavior tracking and analysis can be carried out to obtain users' consumption habits, risk and return preferences, etc. In view of these characteristics of users, financial departments such as banks can implement risk and marketing management.

The application of big data in financial institutions mainly focuses on four areas: risk management, channel optimization, customer management, and operational optimization.

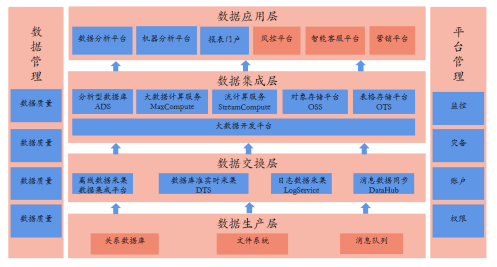

IPACS assists financial enterprises in building and utilizing big data platforms to provide innovative artificial intelligence services for banking business, solving the problems of financial enterprises from different aspects, and enhancing their market competitiveness in the financial industry. Typical application examples include real-time query of historical transaction details, real-time credit reporting, small and micro loan business prediction, and precision marketing.